How San Mateo Funds Street Repaving

A Closer Look at the Citywide Street Rehabilitation Budget

Every year, San Mateo spends more than $8 million to keep its streets in good condition. The way we pay for that work locally is a mix of fees/taxes on driving and general sales tax revenue. I took a look at the latest Fiscal Year 2025-26 Adopted Budget to better understand the plan to fund road maintenance and re-paving.

The 5-year Plan

Smooth Streets Program – The City will continue to commit at least $8 million annually as part of the ongoing program to expedite street resurfacing and reconstruction. This program is funded partially by Measure S, and special revenues such as gas tax, Measure A, Measure W, and Road Maintenance and Rehabilitation Account (RMRA) funds.

Show raw budget data

| Category | 2025–26 Proposed Budget | 2026–27 Plan | 2027–28 Plan | 2028–29 Plan | 2029–30 Plan | 5-Year Total | % of Total |

|---|---|---|---|---|---|---|---|

| RMRA | $2,700,000 | $2,700,000 | $2,700,000 | $2,700,000 | $2,700,000 | $13,500,000 | 32% |

| Measure A | $2,985,000 | $2,425,000 | $2,810,000 | $2,000,000 | $2,000,000 | $12,220,000 | 29% |

| Gas Tax | $1,203,000 | $1,193,000 | $1,193,000 | $1,203,000 | $1,203,000 | $5,995,000 | 14% |

| Measure W | $325,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $4,325,000 | 10% |

| Measure S | $800,000 | $800,000 | $800,000 | $800,000 | $800,000 | $4,000,000 | 9% |

| Taxes, Fees, & Charges | $653,000 | $350,000 | $350,000 | $350,000 | $350,000 | $2,053,000 | 5% |

| Private Contributions | $413,000 | — | — | — | — | $413,000 | 1% |

| General Fund | $205,117 | — | — | — | — | $205,117 | 1% |

| Totals | $9,284,117 | $8,468,000 | $8,853,000 | $8,053,000 | $8,053,000 | $42,711,117 | 100% |

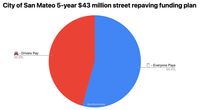

Over the planned 5-year period from 2025-30 the city plans to spend ~$43 million on street paving. About 46% of that total comes from fees tied directly to driving, mainly SB-1’s RMRA fuel taxes, and the Gas Tax. The remaining majority (~54%) comes from taxes and fees that everyone pays into, whether they drive daily, occasionally, or not at all.

Summary

Below is a visual breakdown of where each dollar for street repaving comes from. More than half of San Mateo’s street rehabilitation budget isn’t tied to driving at all, even though pavement wear is overwhelmingly caused by heavier vehicles, not people walking, biking, or riding the bus.

As San Mateo plans for a more sustainable future, it’s important to recognize that our current system effectively subsidizes driving. A fairer approach would let drivers more directly cover the true costs of road wear, freeing up local funds for safer walking, biking, and transit. Understanding how we pay for streets is an important step toward building a healthier, more climate-friendly, and more resilient San Mateo.

A simpler summary of who pays what

Detailed Categories of Funding

User-Fee Revenues 🚘 (RMRA & Gas Tax) — 46% of total

Road Maintenance and Rehabilitation Account (RMRA) — $14M (32%)

This is the City’s largest single source, generated by the statewide SB-1 fuel tax and vehicle fees.

Gas Tax — $6M (14%)

Traditional per-gallon fuel excise taxes supplement SB-1 funds and provide another predictable annual contribution.

Sales-Tax Measures 🧾 — 48% of total

Three countywide or citywide voter-approved sales-tax measures—Measure A, Measure W, and Measure S—collectively fund almost half of the program:

Measure A (2004 half-cent sales tax) — $12M (29%)

San Mateo County’s primary transportation sales tax remains the second-largest funding source.

Measure W (2018 half-cent sales tax) — $4M (10%)

Provides flexible transportation funding, ramping up significantly after FY 2025–26.

Measure S (San Mateo citywide tax) — $4M (9%)

A general-purpose revenue source consistently contributing $800k per year. These measures demonstrate how voter-approved, locally controlled taxes play a critical role in maintaining city infrastructure when state funding alone is insufficient.

Other Local Taxes, Fees, and Charges🧾 — 5%

Taxes, Fees & Charges — $2M (5%)

Represents a blend of smaller revenue streams allocated annually.

One-Time or Project-Specific Contributions — 1–2%

Private Contributions — $413k (1%)

Typically tied to development agreements or frontage improvements.

General Fund Support — $205k (<1%)

Used sparingly, reflecting the City’s need to preserve the General Fund for essential services.